Recently, I had the opportunity to spend a considerable amount of time with a group of senior executives of a major media conglomerate. We discussed about modernization of the technology infrastructure to support the business growth of the organization; primarily in the digital space.

I was supported by our technology team that deals with application modernization. The team carried out a technology assessment study and came to the conclusion that a good 60% of the technology infrastructure will need to be replaced to support digital growth. It was a slam dunk business case- at least so was the team thought.

Within a few days, we heard back from the CFO who was asking for the business justification for the modernization spend. It turned out, to the surprise of many, that the business cases are not so much slam dunk as they were thought to be. There were issues with ROI with some of the business cases. But the bigger problems were around prioritization of initiatives between “Enhancing Consumer Experience” vs “Improving Digital Operation”.

Unfortunately, this is not an isolated business situation at all. Despite the fact, that digital transformation is a must for most companies, organizations have been struggling to prioritize to maximize ROI on their digital investment. Many a times, it become a game of power play, with the functions having better clout at the moment, corner a higher percentage of the investment in their favor.

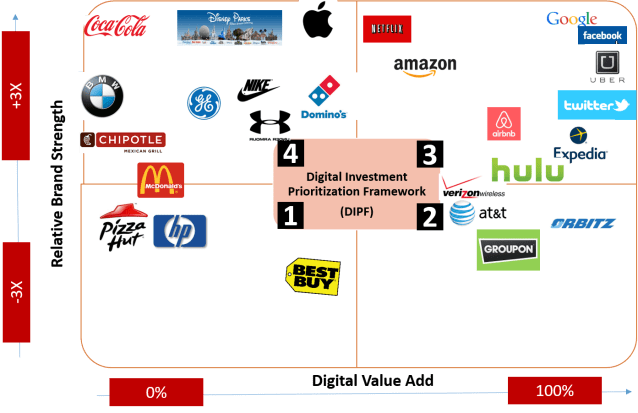

Looking at this problem of prioritization between “Consumer Experience” and “Digital Operation”, we decided to put a simple 2X2 matrix that could drive the investment prioritization decision . We can call it “The “Digital Investment Prioritization Framework” or DIPF.

For the X axis of the framework, we used a parameter of “Digital Value Add”. This value defines the degree to which digital is important to a brand’s core offering (Current). We can use a scale of 0% to 100%. The value of 0% signifies digital has little to no value-add to the brand, where as 100% means that all of the value of the brand is coming from digital.

For Y axis, we used a parameter called “Relative Brand Strength”. This value signifies the current brand strength compared to a brand’s nearest competitor. We can put a scale of -3X to +3X ,which would hopefully can handle most brands within a segment. (This scale could be adjusted)

The idea is to put any brand in one of the four buckets created by this 2X2 matrix and drive the digital prioritization initiative through that grid. To illustrate, we have put some example companies in the four grids that could be used as template. (People may disagree with the placement of the brands in the grid. This placement is purely based on my judgement at this moment)

Grid 1- Here you have a situation where the brand strength is low and digital value add is also small. This group is an extremely vulnerable group and something must be done to enhance the consumer experience through digital value adds. Brands in this group should consider digital operation as secondary, unless it is directly liked with consumer experience.

Take for example the case of Pizza Hut vs Domino’s. Pizza Hut has been struggling with its digital strategy forever. In contrast, Domino’s have leapfrogged in digital experience. Right from social strategy to “order to deliver” experience, Domino’s is a winner in digital. The impact digital has made on Domino’s brand, is for every person to see.

Another example in this grid is a company like Best Buy. Cornered by Amazon, Best Buy has lost much of it sheen. As an electronic retailer it should have a strong digital strategy, but it has failed to gear up to the challenge. The brand, as a result is struggling. Brands such as Blockbuster got obliterated because they could not add digital in their value. This grid is a place of opportunity as well. Many commodity products ranging from fans to light bulbs are adding IOT capabilities and breaking out from grid 1 to grid 4.

Grid 2- This grid comprises of companies that are mostly born out of digital revolution. However, there could be multiple problems in the group. One problem could be the fact that the industry itself is reaching the commodity status because the services are utility in nature.

Take the case of broadband service providers in the consumer space. There is not much to differentiate among Verizon, AT&T or Comcast broadband services, but what makes the difference for the consumer is the quality of the service which is defined by their operational excellence. If the broadband goes down three times a day, no amount of peripheral digital consumer experience is likely to cut it. For this group, digital operation remains a priority. Alternate way of getting out of grid 2 to and move onto grid 3 is to come up with new business models that could monetize the broadband service in all together different ways.

Or take the case of Orbitz. This online travel solution provider is finding it hard to distinguish itself in a commodity market place, which is dominated by Priceline. For a company in this kind of predicament, it could be ideal to look for additional business models as source of revenue. It may not be good enough to concentrate on either consumer experience or operational excellence to survive.

Grid 3- This grid consists of companies that we call “born-digital”, “digital native” or “born to be digital”. This group includes tech companies such as Google, Facebook, Twitter, Uber etc. Majority of the value of these companies is coming from digital. And there is companies like Netflix and Amazon which probably draw 40% value from content/products and 60% from digital.

These companies need to spend equal amount in digital operation and consumer experience. You can’t afford to have Facebook application down for hours. At the same time, the consistent upgrade in consumer experience keep these brands ahead of any potential competition. (Remember how My Space died)

Grid 4- This grid consists of two kinds of companies. There are handful of companies who has a physical brand that’s hard to dislodge. One good example would be Disney parks. It won’t matter to consumers whether Disney park App is working or not for someone to visit the park. Then there are other kind of companies such as Nike or Under Armor, which have invested heavily in digital experience to break out from all other fitness apparel firms in the world. For either of these groups, investment in consumer experience remains a priority over investment in digital operation.

To summarize, companies who are high on digital value, have to focus more on digital operation compared to companies who are less on digital value. The priority on digital investment for organizations will change from Consumer Experience to Digital Operation as brands derive increasingly more value from digital.