Have I not been working in the Media & Entertainment sector and was not so much entrenched with the economics of the sector, I would have probably bought Netflix on 2nd November 2012 at $ 77 ($11 Equivalent post-split price). By that time the shadow of the economic collapse has already faded and one could argue that the stock was a decent buy. Assuming an investment of $20,000 I would have a capital $300,000 just from one stock in three years (15 times).

But I didn’t buy the stock in 2012. I didn’t even buy the stock at $315 ($45 equivalent post-split) in January 2015. Even at January rate, my capital of $20,000 would have grown to $50,000 in six months. With every spike of the stock, I was assuming that it is just a matter of time the stock is going to crash.

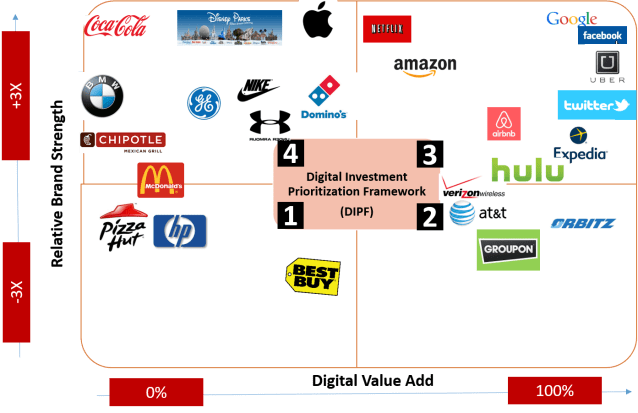

My logic for that belief was very sound. Netflix has been in content distribution business which has a very low barrier to entry. Technically, anybody can put up a platform like that in a few months (albeit, a less robust one) and start streaming content. On top of that, most content providers now a days are very reluctant to share any premium content with Netflix and they are coming up with their own OTT (over the top/broadband) solution (such as HBO GO, CBS, etc.) Also every single carrier ranging from Dish to Verizon are launching their OTT solution, which would compete with Netflix.

New competitors like Amazon Video also pushing hard into the business. YouTube as well is bringing its own subscription service and premium content. All of these services didn’t come up overnight but I knew the overall trend. Being part of media industry, I knew many of these projects are in works and could be launched sooner than later.

While Netflix has come up with chartbuster content like House of cards and Orange is the new Black, I could not believe that that the company could possibly come up with smashing content like that on a consistent basis. In fact other than Disney, how many content providers that we have seen could produce consistently hit content? Even for Disney, they could not have been so consistent with their content strategy if they did not have such amazing franchise collection from Disney, Marvel, Pixar, Lucas films.

Netflix on the other hand does not have any major franchise and building a new franchise brand takes years of consistent success. On the whole, I thought, if we take it as a content brand, it could not be bigger than NBC, Warner Bros or Fox. If we take it as a distribution brand, it has a very low barrier to entry. Overall, I thought my analysis was sound but the new quarter came and once more Netflix had an amazing growth in subscriber numbers and even more amazing growth in its stock.

This time though, I thought that I would take a hard look at myself. I wanted to see my own interaction with Netflix brand to understand why I have been so wrong. I realized that I have a Netflix account for several years now. I cancelled the subscription in 2011 and re-subscribed it in 2013 and I really did not feel the need to cancel it any more. I called up a few friends and family. Everyone has Netflix, everyone use it sparingly and no one thinks of cancelling the service.

I started to think why I did not cancel it in spite of the fact that I am not a very frequent Netflix user. Well, for one thing, my daughter who is five years old, watches her program in Netflix occasionally. And it seems plausible that I was actually quite content paying $7.99/month fee to Netflix after watching the House of Cards series (1,2 & 3 and waiting for something new to come).

On the whole, expectation of new content, occasional catalog content and children’s content was a good enough combo for me to keep the subscription (My wife barely watches TV). One thing was quite sure for me that I was completely aware what I am getting out of Netflix. There is a clear picture in my head about Netflix. It’s definitely a brand, a very clear content brand.

It is a huge realization for me, because when I think of a comparable and older brand like HBO, I don’t have a clear picture about it. I really don’t know what to expect from HBO. I don’t know the difference among HBO, HBO2, HBO Signature, HBO Family, and HBO Zone etc. I also have cancelled and re-subscribed to HBO several time in last ten years. I rarely connect to HBO GO and I don’t have HBO Now subscription since I have HBO with my TV service. Has Netflix done the impossible of making it as strong a content brand in the entertainment business along with Disney, MTV & HBO?

But how did it happen in such a short time? Given that House of Cards is smashing hit and marvel’s daredevil and Orange is the new black did a very good job, there are other content providers who has made similar number of hit content but that did not make them as powerful as Netflix. Even HBO who has been producing great content that includes the Sopranos, Sex and the city, Game of Thrones, Band of brothers, for such a long time is arguably is not an infinitely stronger content brand than Netflix. How did that happen?

I found three reasons why the Netflix brand has gained such strength. I am not a marketing strategist and brand marketers may comment on the validity of this analysis but I could not find any other reasons how Netflix has become a strong content brand. (Not a content distributor brand)

Reason No 1- A very defined access to content.

When we watch content on Netflix, we know for sure that we are watching Netflix (because the overall experience is so different). How many of us remember very quickly, in which network we saw our hit TV series one year after watching it for the last time? HBO Now could become such a brand but it still early days for it. Amazon Video is still trying to find its feet and while YouTube certainly has a good brand, it is truly a brand for short form or user generated content.

Reason No 2- The effect of Binge Viewing

I watched the 1st season of House of Cards series in a span of week during a holiday break when my family was away. I had to forgo part of my daily sleep quota. I barely shaved once in three days and survived on pizza most of the time. I had difficulty concentrating on anything else for that week. I repeated my acts with every new season. (Reed Hastings talked about this strategy of binge viewing in Q4 2011 earnings call and how good it has turned out)

I guess this is probably how the drug addicts behave (I don’t have 1st hand experienceJ). The intensity of viewing left such a deep chasm in my brain that in my lifetime I can’t forget that I watched House of cards on Netflix. In contrast, every new TV show comes once a week. The excitement remains, but it is still controlled and modest. It’s not like a narcotic addiction but may be more like a caffeine addiction. I sometimes wonder, if HBO released The Sopranos like Netflix, how the consumers would have felt about the HBO brand. Would that have etched HBO in their brains forever? Would that make everyone pay $14.99/month as a simple gratitude towards HBO and in the hope that the next Sopranos may be just around the corner?

Reason No 3- Increase in original content

Last year Huffington post and YouGov did a study that came up with a result that half of Netflix subscribers would abandon the service if price goes up by $2. That just does not sound like a characteristics of a strong brand. Netflix themselves mentioned in their 2014 Q3 result that they lost US subscribers because of price increase. But over the next few quarters it was becoming clear to Netflix that the slew of new content that they have brought in, like the House of Cards season 3, Marvel’s daredevil, Dragon has completely changed the perception of Netflix as a content provider. In 2015 itself, Netflix has 34 Emmy nomination for 10 different shows and trailing behind HBO (126 nominations), ABC (42 nomination) and Fox (38 nominations). In terms of pure number of shows, Netflix has already eclipsed HBO, however they still lag HBO in consistent quality of content. Probably am outcome of HBO’s studio based model vs Netflix’s license based model of acquiring content.

The Impact of International Growth

While the growth of the Netflix brand is great, what has really propelled Netflix to a new high is the growth of its international business. It took a while for Netflix to understand its brand power internationally. But when it did, there was no stopping back. In last two years when the domestic market grew at an average of 5% every quarter, international market has grown an average rate of 15% every quarter.

The big advantage for Netflix in international market is, unlike its TV cousins, it is not stuck with multitude of complex deals that inhibits its content being distributed freely. This is particularly true for its original content. Television content distributors are so tangled in these international contracts that they have no option of offering them to international customers in a no holds bar fashion. In addition, European Union is pressing hard for a new rule that that will render geo restriction of content in OTT medium illegal. If that happens, all third party content that Netflix distributes, will be widely available for everybody in entire EU through Netflix.

If you look at the difference between Domestic and International growth in last two years, it is very clear that for international market winter holiday/Christmas is still the peak growth time and it continue to hold for 1st quarter, probably due to House of Cards new season opening.

In contrast, the domestic market is picking on 1st quarter, which is primarily due to House of Cards New Season. One can conclude that international market is a more resilient growth engine and not dependent on power of one show alone.

International paid subscriber base of 22 million in 2nd quarter 2015 stands at more than half of the domestic paid subscriber base of 41 million. At the current growth rates, Netflix will have equal number of international and domestic subscriber base in two years and in four years it will have 65% of its business from international market. One must remember that Netflix has just launched in Japan and it will be launching its services to China in 2016. Indian market could potentially be huge also once India up its broadband penetration.

Why did we discount the international growth all along? I suspect once again we took Netflix as a content distributor and not as content provider and believed any local content distributor could dislodge Netflix with ease. We forgot the fact that the local distributors will not have so much of US content and they will certainly not have House of Cards or Orange is the New Black. Sometimes we underestimate how big a brand United States is and content based on US plots still is a big draw for audiences worldwide.

Is this growth sustainable?

Now all this is good but the nagging question remains. Is this growth sustainable in the context that everyone is coming up with their own OTT offerings? HBO Now ($14.99/Month) has gone live in April 2105. CBS has just launched Showtime ($11.99/month) as well as CBS all access ($5.99) OTT service. Disney is mulling over ESPN OTT service. From the carrier side Dish has launched $20 sling OTT service. Verizon is launching its OTT service just about any time now.

No doubt, these launches will put question mark on Netflix. However my belief is that these services will impact TV services more than Netflix. HBO and Showtime has a pricing inflexibility so not to cannibalize its TV audience. As a consequence Netflix will continue to have the pricing advantage. On top of that, these OTT services are still domestic, whereas Netflix growth engine is international, which will not be impacted by these domestic developments. I also believe that the faster the TV content goes OTT, the faster will be the phenomenon of cord cutting and that might actually give additional support for Netflix domestic growth.

Among the other major competitor in this field is Amazon Web Video Service. My assessment is that if Amazon is serious, they could disrupt Netflix somewhat. But Amazon has its tentacles in so many places, I doubt they will be able to match the intensity of Netflix. Very recently YouTube has announced that it is going to introduce premium original content and also will launch a subscription service. We still have to watch and see how it spans out.

If one thing that is proven right by all these developments is that Netflix is on the right side of this business model and it will continue to grow. It has the 1st mover advantage and it has built a strong brand. Considering its large subscriber base, which allows it to keep its price very low could very well provide a very strong barrier to entry for any new entrant.

In the international market there is growing raze in favor of Net Neutrality. China, India & EU has shown tremendous resistance against any kind of pricing control by bandwidth providers based on type of service they carry. That’s a very good news for growth of Netflix.

In spite of all this positives, the importance of delivering consistently good content remain paramount for Netflix. If it fails in that count, we might see a reversal of all the positives. In absence of little to no bondage of the customer, the destiny of Netflix will be solely controlled by the quality of service and content that Netflix will bring. It’s a strategy that Netflix has embraced out of its own choice and this strategy has very little margin of error.

What about pricing power?

Whenever it comes to pricing power of Netflix, people refer to Quarter 2, 2014 result of Netflix when allegedly Netflix subscriber growth dropped because of price Increase. However, if you look at the growth pattern in Q2 over Q1 year on year, it is very clear that the domestic growth is in a declining mode. The problem in Q2 of 2014 was that of the international growth which stumbled to 9.8% and could not make up for domestic decline. The slowness of Q2 in 2014 could not be attributed to price as there was no price increase internationally. It was an international execution issue as explained by Netflix when they presented their Q4 2014 result.

However, I suspect that for several years Netflix themselves has feared the pricing sensitivity of its business model. With better content at its disposal, Netflix could feel liberated now. The current pricing base is so low for Netflix, that even a $1 increase in subscription fee will add more than 12% to the bottom-line. New OTT services like HBO and ShowTime, which are priced at $14.99 and $11.99 has given Netflix a legitimate reference frame to work with. As of now, Netflix could easily increase its subscription by a dollar and I am positive it will not have any impact on its subscription base.

It could however face challenge with Verizon like OTT service which are powered by ad revenue. It may be possible that in future Netflix has to offer a premium an ad supported model for its content. That kind of a model could provide a lot of pricing flexibility to Netflix.

What about Investment, Expenses & Cash flow?

Netflix operating profit was at 3% of its revenue in Q1 2013. Over a period of year and half it grew up to 10% (Q2 2014) of revenue. However operating profit again went downhill from here and at the last quarter (Q2 2015) the operating income stands at 4% of revenue. The decrease is primarily due to increase in Marketing and Technology cost. I would presume that it is driven by their international expansion.

Given the strategy of Netflix is international expansion, I don’t see this number improving soon. But I don’t think anyone cares about operating margin of Netflix (at least next two quarters) as long as the topline growth remains strong. It will though become an issue later on when growth slows.

Netflix is also investing heavily on content and we know that good content does not come cheap. In 2014 alone, Netflix has added $3.7 BN investment in content. In six months of 2015, they have spent $2.5 Billion (Based on cash flow data. Addition of streaming content library). These are significant numbers and impact cash flow of Netflix as they amortize the investment over a four year period. However, with subscriber growth, Netflix will not require to invest in content on proportional basis. That should improve its cash flow by a large extent.

What should You, I should do now?

Now what about the next quarter? Will Netflix beat the Q3 guidance? The guidance given by Netflix is 1.13 million net domestic subscriber addition and 2.4 international net subscriber addition (Including free trials). I have come up with my own estimate on next quarter numbers. As per my analysis, Netflix may fall short on domestic growth but it will more than make it up in international growth.

Netflix will launch in Japan towards the end of Q3 and will launch in Spain, Portugal and Italy in Q4. That should propel further growth during the year end. Japan could prove to be an ideal growth engine for Netflix, but it probably would take a few quarters for Japanese customers to embrace Netflix (That is a typical Japanese trend). But once established, just like Starbucks it could speed up the subscriber growth.

However, the real story that everyone would wait for is China, where Netflix will launch its service 2016. House of cards, which was launched through Sohu TV in China by Netflix was a blockbuster success. Given the Chinese affection for a good brand, my guess is people are waiting to lap up Netflix in China.

If Netflix can crack the China code, its subscription level could be propelled to the territory we have not imagined yet. However, exposure to international content is a thorny issue in communist China and we have to watch and see how Netflix approach the issue. If it could cross the political hurdle, I am certain that Netflix subscription level would grow exponentially from the current level.

Reed Hastings talks about 60-90 million domestic subscriber at peak level and the fact that eventually domestic subscription would be around 35% of total global subscription. That could take Netflix subscription level at 250 million households worldwide from its current level of 60 million worldwide households. At the current growth rate, that could be achieved in next five years. (The current growth pattern clearly support this 65% (international): 35 (domestic) theory.

If Netflix at the same period could increase its price by a modest 20% (which should be easily doable) and maintain its current investment at content (which is already quite high), we will witness a huge increase in profit for Netflix in next few years.

A suggestion for Netflix

And what about Netflix itself? Could it do something different from content strategy side? In my mind, they should invest on buying some new Franchise and not rely exclusively on license model for content acquisition. Steady Franchises may improve the consistency of quality from their part. For a start, both DreamWorks and Take Two interactive would be great buy.

Netflix already is a large customer of DreamWorks. So the working relationships must be already established. If they acquire Take Two Interactive, Netflix will get access to franchises like Grand Theft Auto. This could open up a completely new vista for Netflix in gaming sector and give the company a new kind of pricing power.